-

The Surprising Trend in the Number of Homes Coming onto the Market

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

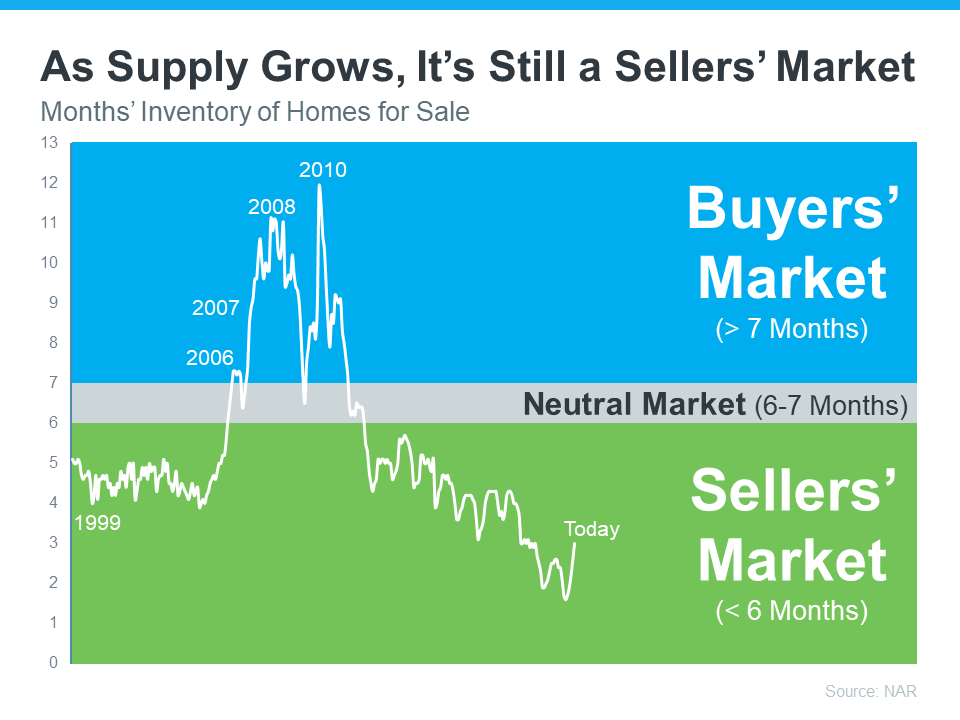

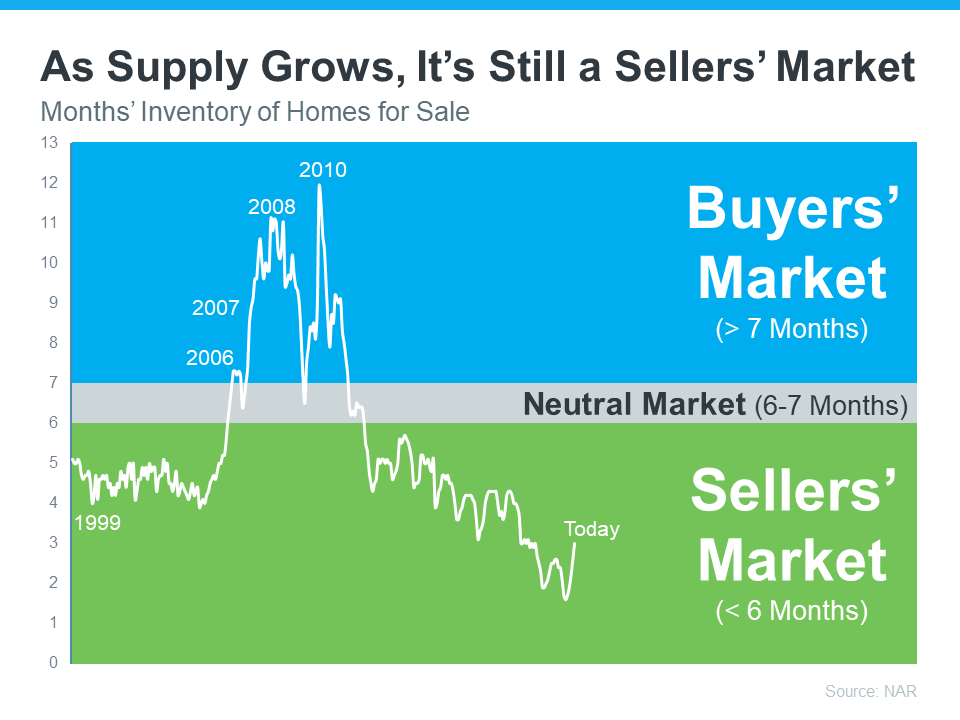

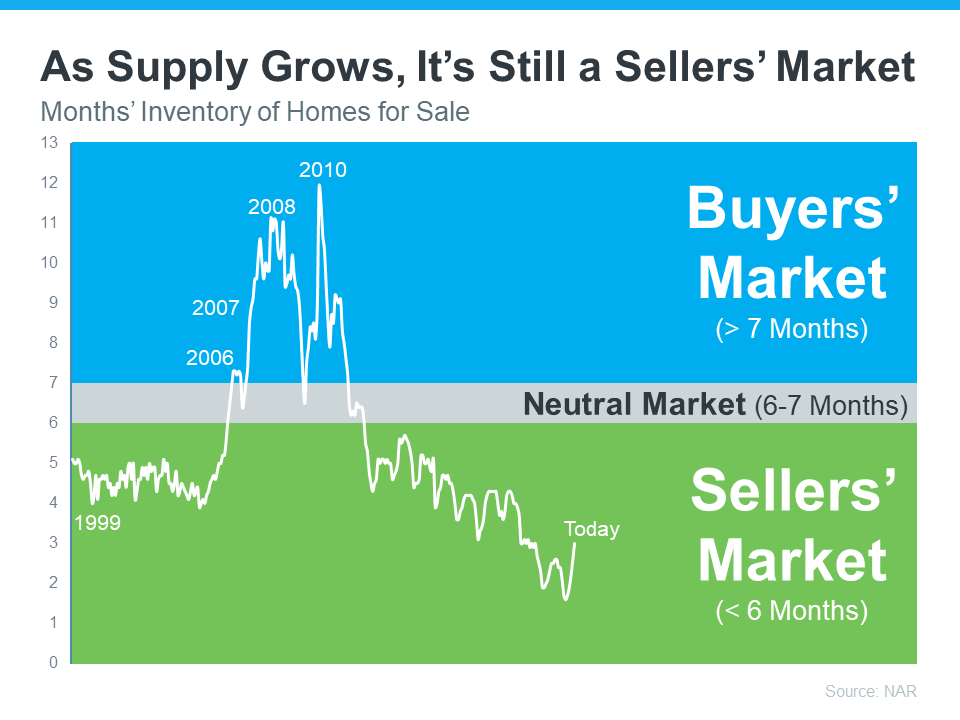

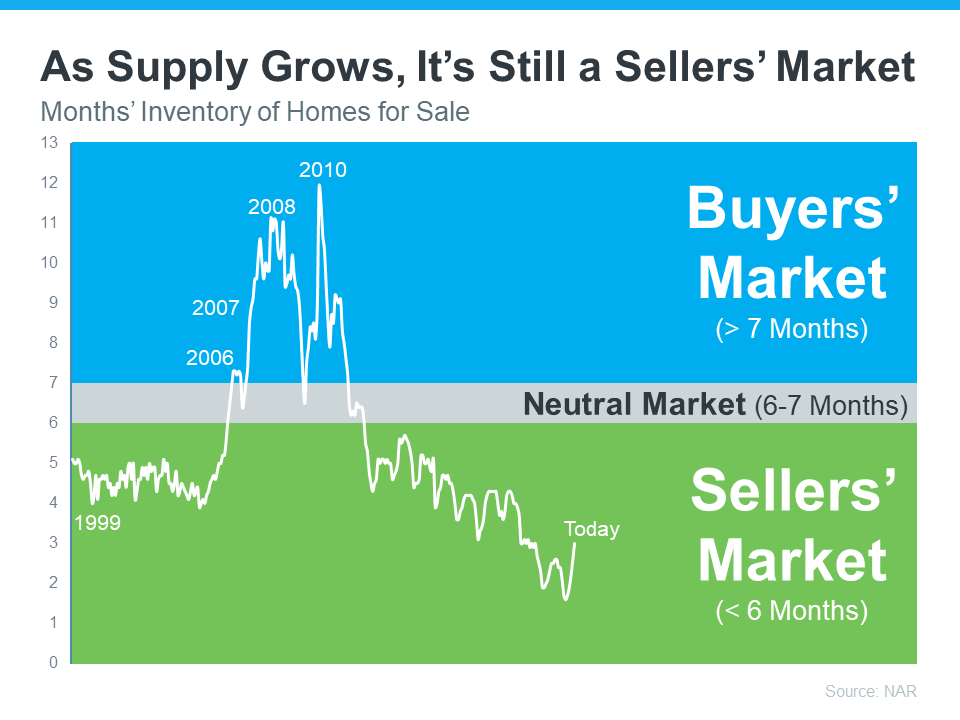

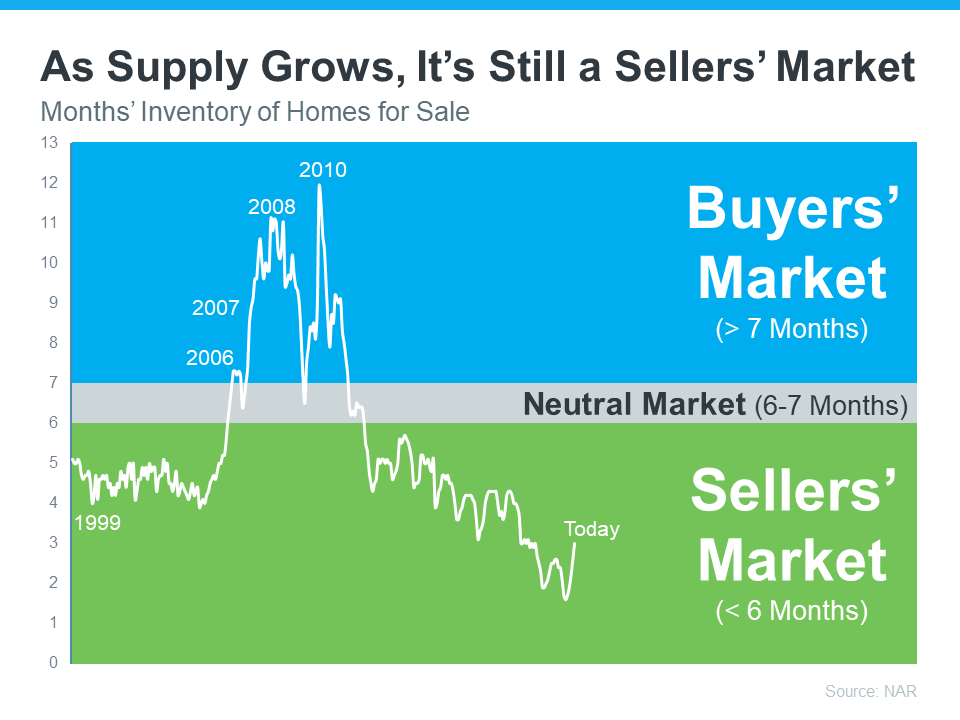

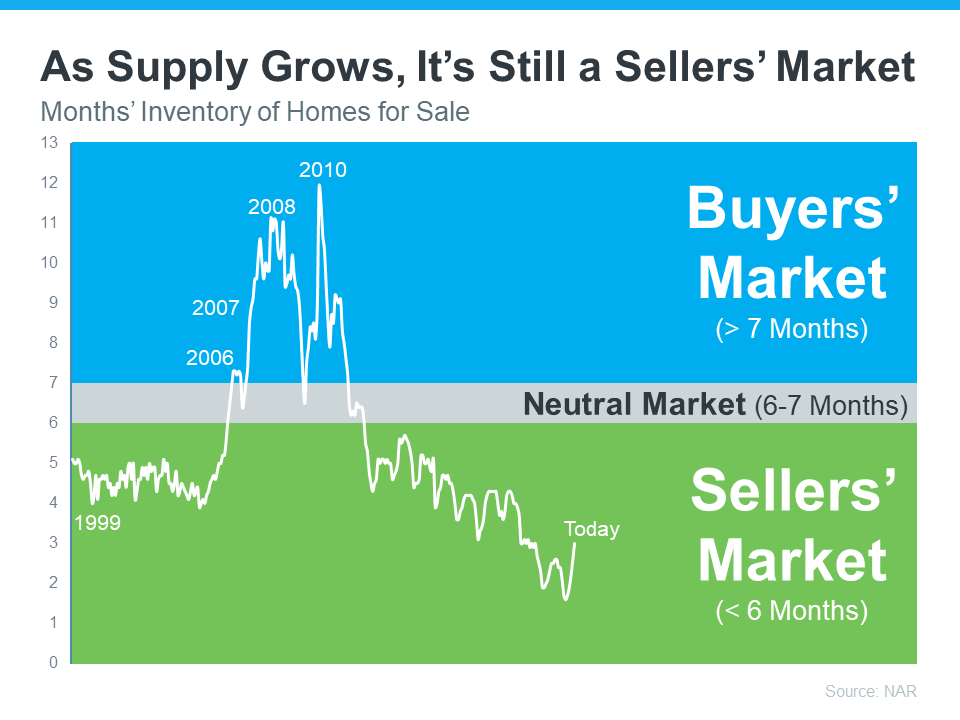

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

If you’re thinking about moving, it’s important to know what’s happening in the housing market. Here’s an update on the supply of homes currently for sale. Whether you’re buying or selling, the number of homes in your area is something you should pay attention to.

In the housing market, there are regular patterns that happen every year, called seasonality. Spring is the peak homebuying season and also when the most homes are typically listed for sale (homes coming onto the market are known in the industry as new listings). In the second half of each year, the number of new listings typically decreases as the pace of sales slows down.

The graph below uses data from Realtor.com to provide a visual of this seasonality. It shows how this year (the black line) is breaking from the norm (see graph below):

Looking at this graph, three things become clear:

- 2017-2019 (the blue and gray lines) follow the same general pattern. These years were very typical in the housing market and their lines on the graph show normal, seasonal trends.

- Starting in 2020, the data broke from the normal trend. The big drop down in 2020 (the orange line) signals when the pandemic hit and many sellers paused their plans to move. 2021 (the green line) and 2022 (the red line) follow the normal trend a bit more, but still are abnormal in their own ways.

- This year (the black line) is truly unique. The steep drop off in new listings that usually occurs this time of year hasn’t happened. If 2023 followed the norm, the line representing this year would look more like the dotted black line. Instead, what’s happening is the number of new listings is stabilizing. And, there are even more new listings coming to the market this year compared to the same time last year.

What Does This Mean for You?

- For buyers, new listings stabilizing is a positive sign. It means you have a more steady stream of options coming onto the market and more choices for your next home than you would have at the same time last year. This opens up possibilities and allows you to explore a variety of homes that suit your needs.

- For sellers, while new listings are breaking seasonal norms, inventory is still well below where it was before the pandemic. If you look again at the graph, you’ll see the black line for this year is still lower than normal, meaning inventory isn’t going up dramatically and prices aren’t heading for a crash. And with less competition from other sellers than you’d see in a more typical year, your house has a better chance to be in the spotlight and attract eager buyers.

Bottom Line

Whether you’re on the hunt for your next home or thinking of selling, now might just be the perfect time to make your move. If you have questions or concerns about the availability of homes in our local area, let’s connect.

-

Top 2026 Housing Markets for Buyers and Sellers

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

Who doesn’t love a top 10 list? Well, here are two top 10 lists for the housing market this year. But before you take a look, there’s something you should know.

If a move is on your radar for 2026, here’s the most important thing you need to understand upfront: there isn’t one housing market this year – there are many.

Experts agree 2026 is shaping up to be one of the most geographically split housing markets in years. Some areas are tilting in favor of sellers, while others are opening real doors for buyers. Who has the advantage depends almost entirely on where you are. Selma Hepp, Chief Economist at Cotality, puts it this way:

“Looking ahead to 2026, regional differences will remain pronounced, with demand favoring areas that offer both economic opportunity and relative affordability.”

To show just how divided the landscape is, here’s a look at where sellers are expected to have the upper hand, and where first-time buyers may finally find their opening this year.

Where Sellers Are Poised To Win Big in 2026

Zillow identified the following metros as some of the strongest seller markets for 2026, based on buyer demand, pricing momentum, and how quickly homes are expected to sell:

In markets like these, buyers are going to be competing for limited inventory, which gives sellers more leverage.

Homeowners in seller’s markets this year can expect:

- Stronger buyer interest

- Shorter time on market

- Better odds of selling close to (or above) asking price

That doesn’t mean every listing is guaranteed success. But it does mean sellers who prepare well and lean on an agent’s expertise should be very happy with their results in 2026.

Markets Where There’s More Opportunity for First-Time Buyers

On the flip side, here’s a look at where buyers have the power – in particular, first-time buyers, since they’ve had the hardest time breaking into the market lately. Realtor.com highlights the top metros where first-time buyers are expected to have better opportunities in 2026:

These markets stand out for a mix of:

- More affordable home prices

- Better housing availability

- Strong local amenities and economic health

For first-time buyers, that combination matters. It’s what could finally turn “someday” into “this could actually work.” In buyer’s markets, they should expect:

- Less intense competition

- More room to negotiate

- A clearer path to getting an offer accepted

What Matters More Than Any Top 10 List

Not seeing your city on the list? Don’t stress. This is just a national snapshot, not a judgment on your local market. The goal here is just to show you how different the market really is depending on where you are.

And remember, you can buy or sell no matter how your local market leans. You just need an agent’s help to figure out the right strategy to get it done. For example:

- A seller in a more buyer-friendly metro may need to be aggressive on their price and prep.

- A buyer in a seller-leaning area may still need to come prepared with their best offer.

To find out where your market falls and what you should expect, you’ll want the help of a local expert.

Bottom Line

The housing market in 2026 isn’t one-size-fits-all. It’s a year where local conditions matter more than ever.

Whether your market leans more buyer-friendly or seller-friendly, the right strategy can put you in a strong position. And that’s where a local expert comes in. Let’s connect.

-

Why Some Homes Sell Quickly – and Others Don’t Sell at All

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

A few years ago, inventory hit a record low. Just about anything sold – and fast. But now, there are far more homes on the market. Listings are up almost 20% from this time last year. And in some areas, supply is even back to levels we last saw in 2017–2019. For sellers, that means one thing:

Your house needs to stand out and grab attention from day one.

That’s especially true when you consider why the number of homes for saleis up. Here’s how it works. Available inventory is a mix of:

- Active Listings: homes that have been sitting on the market, but haven’t sold yet

- New Listings: homes that were just put on the market

Data from Realtor.com shows most of the inventory growth lately is actually from active listings that are staying on the market and taking longer to sell (see the graph below).

The blue bars show active listings. These are the homes that are sitting month to month and not selling. The green bars are new listings, the homes that were just put on the market. And it’s clear there are fewer new listings compared to how many are staying on the market unsold.

Since you don’t want your house to be one of the ones that take a long time to sell, let’s break down where things can go sideways and how to set yourself up to sell quickly.

Why Some Homes Sell and Others Sit

The secret to selling in today’s market is simple. Make sure your house is easy for buyers to say yes to as soon as it is listed.

Price it based on current conditions (not what your neighbor sold for 3 years ago). Make important repairs. And highlight the best things about your house. If you do that, it will sell in any market – sometimes even faster than you’d think. Because the truth is, homes that are priced right today are still selling.

It’s the homeowners who are clinging to outdated expectations that are seeing their house sit and their listing go stale. According to Redfin and HousingWire, here are some of the most common reasons sales stall out:

- Priced it too high from the start

- Skipped necessary repairs before listing

- Didn’t stage the house well

- Sellers won’t negotiate with buyers

- Limited availability for showings

- Ineffective marketing or listing pictures

Most of those things didn’t matter as much just a few years ago. When inventory was at a record low, sellers could skip the prep, name their price, and still walk away with multiple offers over their asking price.

But today’s market is different now that inventory has grown. And that means your approach needs to be different too.

You don’t want to try out old strategies and aim too high just to see what sticks. Your first few weeks on the market are everything. That’s when your listing gets the most attention – and when pricing or presentation mistakes hurt the most. Get it wrong up front and your house will sit…and sit. Get it right, and it’ll be snatched up before you know it.

The Right Agent Helps Your House Stand Out

Selling quickly isn’t about luck. It’s about knowing how to play to the market you’re in. And that’s where your agent comes in.

A great agent will analyze your local market, suggest a price based on the latest comparables sold in your neighborhood, and create a marketing plan that makes buyers pay attention from day one. They’ll also walk you through any repairs you need to make or whether you need to bring in a staging company. As the National Association of Realtors (NAR) explains:

“Home sellers without an agent are nearly twice as likely to say they didn’t accept an offer for at least three months; 53% of sellers who used an agent say they accepted an offer within a month of listing their home.”

That’s the power of getting it right (and getting expert help) from the start.

Bottom Line

There are more homes for sale today than there were even just a year ago, but that doesn’t have to work against you.

When your house is priced right, shows well, and is marketed effectively, it will sell. Let’s connect if you want to know how to make that happen in our market this fall.

-

2026 Housing Market Outlook

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

After a couple of years where the housing market felt stuck in neutral, 2026 may be the year things shift back into gear. Expert forecasts show more people are expected to move – and that could open the door for you to do the same.

More Homes Will Sell

With all of the affordability challenges at play over the past few years, many would-be movers pressed pause. But that pause button isn’t going to last forever. There are always people who need to move. And experts think more of them will start to act in 2026 (see graph below):

What’s behind the change? Two key factors: mortgage rates and home prices. Let’s dive into the latest expert forecasts for both, so you can see why more people are expected to move next year.

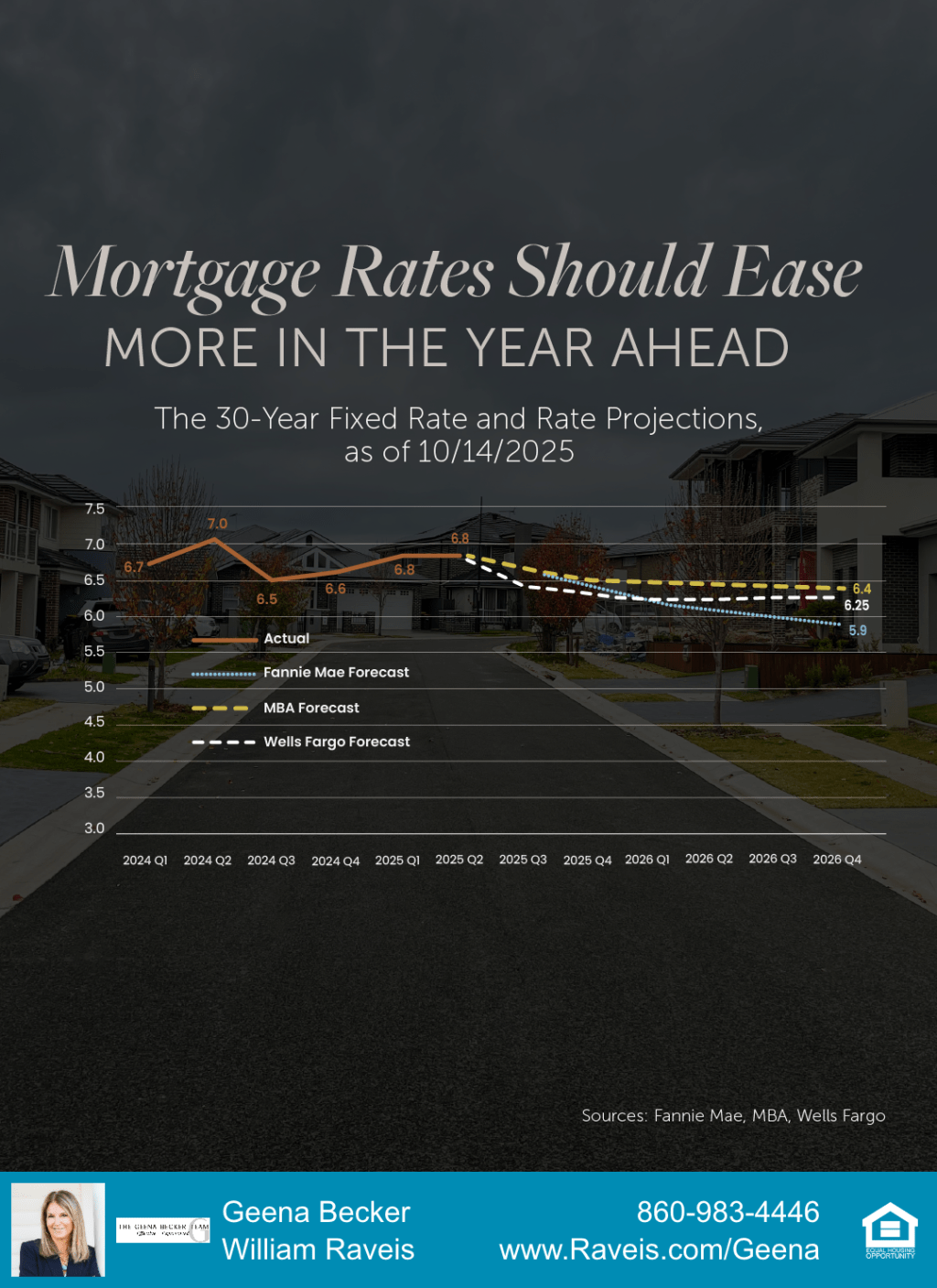

Mortgage Rates Could Continue To Ease

The #1 thing just about every buyer has been looking for is lower mortgage rates. And after peaking near 7% earlier this year, rates have started to ease.

The latest forecasts show that could continue throughout 2026, but it won’t be a straight line down (see graph below):

There’s a saying: when rates go up, they take the escalator. But when they come down, they take the stairs. And that’s an important thing to remember. It’ll be a slow and bumpy process.

Expect modest improvement in mortgage rates over the next year but be ready for some volatility. There will be volatility along the way as new economic data comes out. Just don’t let it distract you from the bigger picture: the overall trend will be a slight decline. Forecasts say we could hit the low 6s, or maybe even the high 5s.

And remember, there doesn’t have to be a big drop for you to feel a change. Even a smaller dip helps your bottom line.

If you compare where rates are now to when they were at 7% earlier this year, you’re already saving hundreds on your future mortgage payment. And that’s a really good thing. It’s enough to make a real difference in affordability for some buyers.

Home Price Growth Will Be Moderate

What about prices? On a national scale, forecasts say they’re still going to rise, just not by a lot. With rates down from their peak earlier this year, more buyers will re-enter the market. And that increased demand will keep some upward pressure on prices nationally – and prevent prices from tumbling down.

So, even though some markets are already seeing slight price declines, you can rest easy that a big crash just isn’t in the cards. Thanks to how much prices rose over the last 5 years, even the markets seeing declines right now are still up compared to just a few years ago.

Of course, price trends will depend on where you are and what’s happening in your local market. Inventory is a big driver in why some places are going to see varying levels of appreciation going forward. But experts agree we’ll see prices grow at the national level (see graph below):

This is yet another good sign for buyers and overall affordability. While prices will still go up nationally, it’ll be at a much more sustainable pace. And that predictability makes it easier to plan your budget. It also gives you peace of mind that prices won’t suddenly skyrocket overnight.

Bottom Line

After a quieter couple of years, 2026 is expected to bring more movement – and more opportunity. With sales projected to rise, mortgage rates trending lower, and price growth slowing down, the stage is set for a healthier, more active market.

So, the big question: will you be one of the movers making 2026 your year?

Let’s connect if you want to get ready.

-

Why Home Sales Bounce Back After Presidential Elections

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

With the 2024 Presidential election fast approaching, you might be wondering what impact, if any, it’s having on the housing market. Let’s break it down.

Election Years Bring a Temporary Slowdown

In any given year, home sales slow down slightly in the fall. It’s a typical, seasonal trend. However, according to data from BTIG, in election years there’s usually a slightly larger dip in home sales in the month leading up to Election Day (see graph below):

Why? Uncertainty. Many consumers hold off on making major decisions or purchases while they wait to see how the election will play out. It’s a pattern that’s shown up time and time again, and it’s particularly apparent for buyers and sellers in the housing market.

This year is no different. A recent survey from Redfin found that 23% of potential first-time homebuyers said they’re waiting until after the election to buy. That’s nearly a quarter of first-time buyers hitting the pause button, likely due to the same feelings of uncertainty.

Home Sales Bounce Back After the Election

The good news is these delayed sales aren’t lost forever—they’re just postponed. History shows sales tend to rebound after the election is over. In fact, home sales have actually increased 82% of the time in the year after the election (see chart below):

That’s because once the election dust settles, buyers and sellers have a sense of what’s ahead and generally feel more confident moving forward with their decisions. And that leads to a boost in home sales.

What To Expect in 2025

If history is any indicator, that means more homes will sell next year. And based on the latest forecasts, that’s exactly what you should expect. As the graph below shows, the housing market is on pace to sell a total of 4.6 million homes this year, and projections are for 5.2 million total sales next year (see graph below):

And that aligns with the typical pattern of post-election rebounds.

So, while it might feel like the market is slowing down right now, it’s more of a temporary dip rather than a long-term trend. As has been the case before, once the election uncertainty passes, buyers and sellers will return to the market.

Bottom Line

It’s important to remember that while election years often bring a short-term slowdown in the housing market, the pause is usually temporary. Those sales are not lost. Data shows home sales typically increase the year after a Presidential election, and current forecasts indicate 2025 will be no different. If you’re waiting for a clearer picture before making a move, just know that the market is expected to pick up speed in the months ahead.

-

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision.

1. Should I Wait To Sell?

Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year.

2. Are Buyers Still Out There?

If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains:

“At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.”

While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for.

3. Can I Afford To Buy My Next Home?

If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize.

Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American:

“. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.”

Bottom Line

If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today.

Two Reasons Why the Housing Market Won’t Crash

You may have heard chatter recently about the economy and talk about a possible recession. It’s no surprise that kind of noise gets some people worried about a housing market crash. Maybe you’re one of them. But here’s the good news – there’s no need to panic. The housing market is not set up for a crash right now.

Real estate journalist Michele Lerner says:

“A housing market crash happens when home values plummet due to a lack of demand for homes or an oversupply.”

With that definition in mind, here are two reasons why this just isn’t on the horizon.

1. Demand for Homes Is Higher than Supply

One of the biggest reasons the housing market crashed back in 2008 was an oversupply of homes. Today, though, it’s a very different story.

It’s a general rule of thumb that a market where supply and demand are balanced has a six-month supply of homes. A higher number means supply outpaces demand, and a lower number means demand outpaces supply. The graph below uses data from NAR to put today’s situation into context:

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

Put simply, there are more people who want to buy homes than there are homes available to buy right now. So, demand is greater than supply. When that happens, home prices stay steady or rise – the opposite of a housing market crash.

It’s important to note that inventory levels differ from market to market. Some areas may be more balanced, while a few could have a slight oversupply, which can impact prices locally. However, most markets continue to experience a shortage of homes.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

2. Unemployment Is Still Low

When people are unemployed, they’re more likely to have trouble making their mortgage payments and may be forced to sell or face foreclosure. That was a big problem during the 2008 financial crisis. Today, the employment situation is much more stable (see graph below):

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Right now, people are working, earning an income, and making their mortgage payments. That’s one reason why the wave of foreclosures that happened in 2008 isn’t going to happen again this time. Plus, since so many people are employed right now, many are actually in a position to buy a home, and this demand keeps upward pressure on prices.

Today’s Housing Market Is Stronger than in 2008

While it’s understandable to be concerned when you hear talk of a recession and economic uncertainty, but know this: the housing market is in a much better place than it was in 2008. According to Rick Sharga, Founder and CEO at CJ Patrick Company:

“Literally everything is different about today’s housing market dynamics than the conditions that led to the housing crisis.”

Demand for homes still outpaces supply, and unemployment remains low. And these are two key factors that will help prevent the housing market from crashing any time soon.

Bottom Line

The housing market is doing a lot better than it was in 2008, but it’s important to remember that real estate is very local.

So, it’s always a good idea to stay informed about our specific market. If you have any questions or want to discuss how these factors are playing out in our area, feel free to reach out.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.